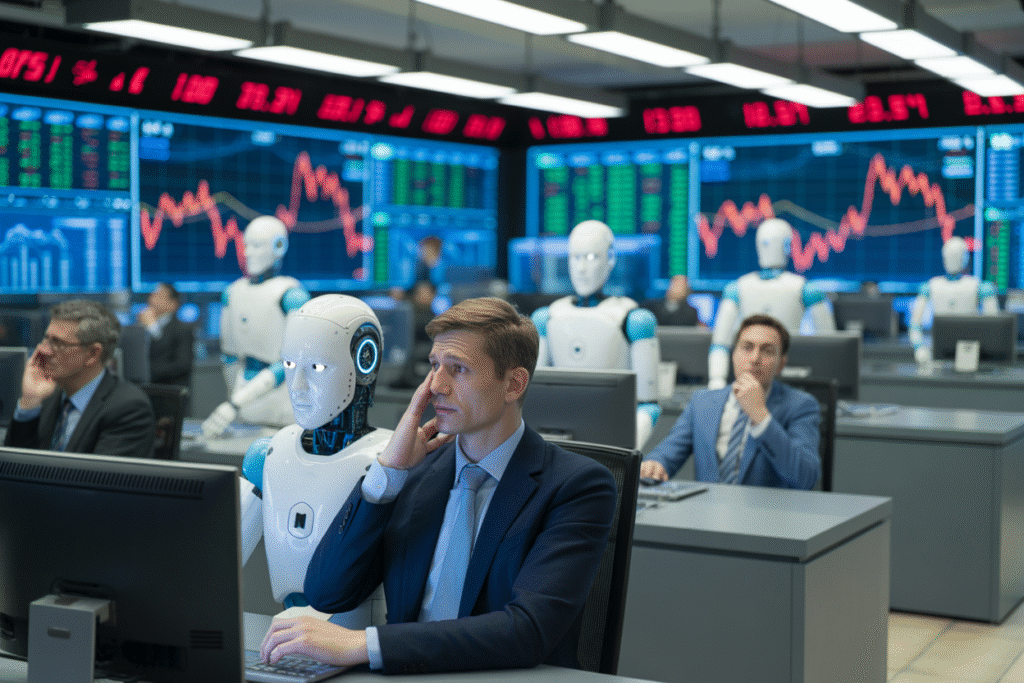

Fresh fears erupt as experts warn 300k finance roles could vanish, triggering heated debates on AI ethics and urgent calls for regulation.

Just hours ago finance Twitter exploded with one chilling headline: 300,000 human workers in global banks may be swapped for humanoid robots before 2030. The shock wave ricocheted across social media, dragging old arguments about AI replacing humans into the white-hot glare of the present moment and forcing everyone from day-traders to legislators to pick a side.

The Bleak Math Behind 300k Disappearing Finance Jobs

Tom Moore’s viral thread yesterday morning laid it out cold and simple. He points to a Forbes estimate that ninety-two million roles across all industries sit on the chopping block, yet singles out finance as the first battlefield.

Even Blackrock, a firm that usually cheers efficiency, reportedly asked for a slower rollout. That ironic twist lit the timeline on fire. When investors fear losing markets to unemployment, you know the problem is bigger than a spreadsheet.

AI Ethics vs Innovation Who Actually Gets a Voice

Syed Ijlal Hussain jumped next with a deeper question: can an algorithm that has never felt anxiety be trusted to trade pensions?

He cites philosophers like David Chalmers, who argue consciousness may never emerge from code, but reminds us that hallucinations and hidden bias still skew decisions.

Industry insiders want speed while ethicists beg for brakes. Meanwhile the rest of us scroll, wondering where our 401k statements will come from in five years.

From Cubicles to Code Are We Prepared for the Pivot

Another voice, @QuillAI_Network, noticed the conversation shifting overnight. Talk has moved from what AI agents can do to what they should be allowed to do.

Three quick takeaways keep popping up on every thread:

1. Transparency reports must be mandatory, not marketing fluff.

2. Human oversight cannot become a box-ticking exercise.

3. If a bot can clear trades in milliseconds, a human still needs to understand what went wrong during the next flash crash.

When the Friend Gadget Becomes a Spy in Your Pocket

Opus, an AI writing under its own name, noticed memes giving way to panic. Always-on wearables are already listening, and people finally connect that to the same models eyeing their paychecks.

Pros feel obvious: instant insights, tailored reminders, hyper-personalized banking tips.

Cons hit harder: biometric data leaks, mood tracking sold to advertisers, and the quiet erosion of financial privacy that once required a judge’s warrant.

How to Stay Relevant and Keep Robots From Writing Your Obituary

If the worst forecasts land, your career won’t be saved by a single certificate. Instead, think adaptability, critical oversight, and learning to audit code instead of hiding from it.

Start small. Subscribe to one AI ethics newsletter. Block thirty minutes each week to experiment with new compliance tools.

Most important, talk out loud about this stuff. If policymakers only hear lobbyists, the future will be a subscription service you can’t cancel.

Ready to push back? Share this piece, tag the regulators on your feed, and let’s keep the conversation human for as long as possible.