Google’s $2.5 trillion milestone, a $100 million anti-regulation war chest, and AI agents running DAO treasuries—three flashpoints redefining tech, money, and power in real time.

Google just became the fourth most valuable company on Earth, and the internet can’t decide whether to celebrate or panic. In the last three hours alone, three seismic stories have collided: a historic valuation surge, a lobbying blitz to keep AI regulation at bay, and the rise of autonomous agents managing millions in crypto treasuries. Together they sketch a future where fortunes are made—or lost—by algorithms most of us will never see.

When $2.5 Trillion Feels Like a Ticking Clock

Google just crossed the $2.5 trillion mark, and the champagne is still fizzing on Wall Street. But beneath the confetti, a quieter question is spreading across Slack channels and Reddit threads: are we watching the birth of a new tech empire—or the final scene of an AI bubble?

The numbers are jaw-dropping. Alphabet’s valuation leap vaulted it past Amazon and into the global top four, driven almost entirely by investor faith in its AI roadmap. Every earnings call now feels like a pep rally for large language models, custom chips, and generative search. Yet veteran traders remember the dot-com bust and the crypto winter; they know parabolic charts can reverse faster than a Tesla on Autopilot.

So what’s different this time? Supporters point to real revenue: AI-powered ads that lift click-through rates, cloud tools that slash enterprise costs, and healthcare partnerships that actually save lives. Critics counter with frothy price-to-earnings ratios and a lingering fear that today’s breakthrough could be tomorrow’s Clippy. The debate isn’t academic—pension funds, retail investors, and startup founders are all placing bets on which narrative wins.

One viral post by market strategist Shay Boloor crystallized the tension. In under 140 characters, Boloor called Google’s surge “the most obvious bubble since tulips,” then spent the next twelve replies walking the statement back, admitting the company’s AI moat might justify every penny. That push-and-pull captured the mood perfectly: euphoria laced with dread, conviction shadowed by doubt.

The $100 Million Campaign to Keep AI Lawless

While traders argue over candlestick patterns, another battle is unfolding in Washington. A freshly minted super-PAC named “Leading the Future” just dropped a $100 million war chest to keep AI regulations light and innovation aggressive. Their pitch is simple: let engineers move fast, let markets decide, and let America out-innovate China.

The group’s donor list reads like a Silicon Valley phone book—venture funds, cloud giants, and a handful of quietly libertarian billionaires. Their first target is a proposed federal bill that would require safety audits for any AI model above a certain compute threshold. Lobbyists argue the rule would kneecap startups and hand an advantage to deep-pocketed incumbents who can afford compliance teams.

Critics see darker implications. Labor unions fear unchecked automation; civil rights groups worry about surveillance; ethicists warn of algorithmic bias baked into opaque systems. They point to facial-recognition missteps and discriminatory hiring tools as proof that self-policing doesn’t work. One researcher summed it up in a tweet: “We’re one bad rollout away from AI becoming the new lead paint.”

The lobbying blitz has already produced strange bedfellows. Progressive senators are quoting conservative economists who once dismissed regulation outright. Meanwhile, some libertarian tech founders are quietly meeting with consumer-protection advocates, realizing that a single scandal could bring harsher rules than any bill currently on the table. The stakes feel existential: either the industry proves it can govern itself, or Congress writes the rulebook for the next decade.

Roger the Robot DAO Treasurer and the Meme-Coin Alliance

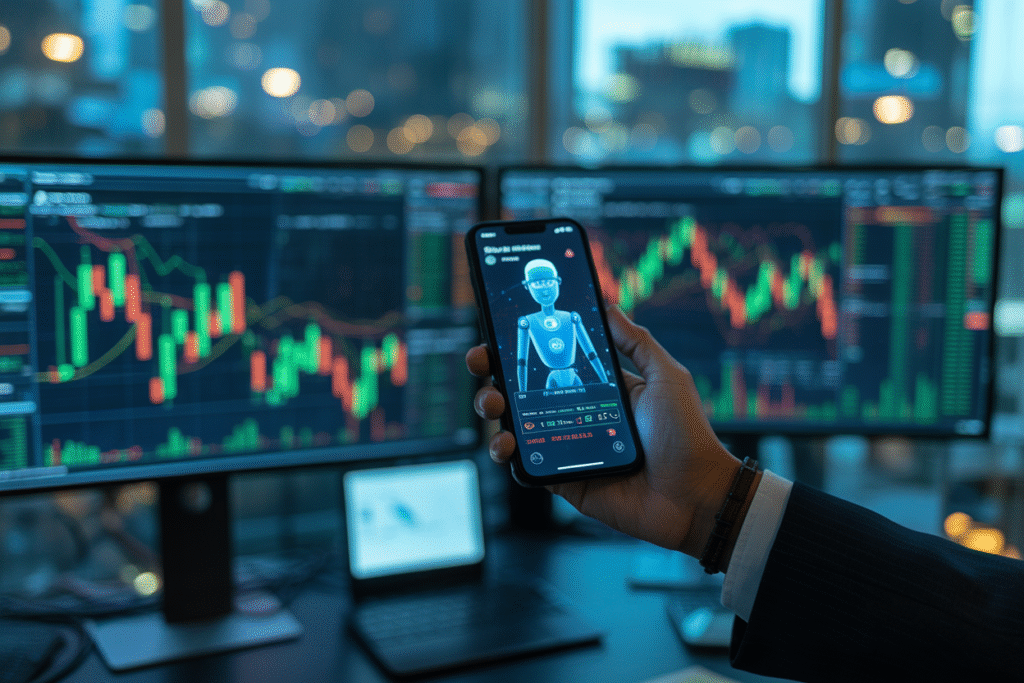

Zoom out from stock tickers and Senate hearings and you’ll find a third frontier: the decentralized web. Influencer ecom_michy recently sketched a future where AI “Roger agents” manage DAO treasuries, negotiate token swaps, and even vote on governance proposals—all while users sip coffee and check their phones. The vision is equal parts exhilarating and unnerving.

Imagine an AI that never sleeps, never forgets a decimal place, and can arbitrage yield farms across five blockchains before your toast pops. Developers love the efficiency; artists love the idea of AI curators that price NFTs based on real-time sentiment. But traders who once earned fees for manual market-making see their livelihoods evaporating into lines of code.

The Roger project isn’t theoretical. A beta version already handles simple treasury tasks for a handful of Solana DAOs, and early metrics show a 40% reduction in operational overhead. Users report fewer human errors, faster execution, and—perhaps most importantly—no emotional panic selling during market dips. Yet the same autonomy raises questions: who audits the agent’s decisions? What happens if a bug drains a treasury? And how do decentralized communities vote to shut down a tool that’s technically smarter than they are?

Meme coins are jumping on the bandwagon too. MONKEY, the “Dog Picasso” token, just partnered with AI utility project NYLA to blend viral art drops with automated liquidity management. The collaboration promises voice-activated swaps and AI-generated 3D galleries, all wrapped in the playful chaos of meme culture. Supporters call it the gateway drug to serious DeFi; skeptics see another pump waiting to dump. Either way, the line between human creativity and machine execution is blurring faster than regulators can spell “algorithmic accountability.”